Introduction:

In the world of investments, gold has stood the test of time as a symbol of enduring value and stability. Among the various forms and sizes of gold bars, the 250g gold bar has emerged as a pragmatic choice for investors seeking a balance between substantial value and manageable size. In this article, we explore the allure of the 250g gold bar examining its features, advantages, and the reasons why it holds a special place in the portfolios of discerning investors.

Optimal Size, Substantial Value:

The 250g gold bar strikes a balance between size and value, making it an attractive investment option. While larger bars may require significant capital and present challenges in terms of storage and liquidity, smaller bars may lack the same investment gravitas. The 250g gold bar provides investors with a meaningful amount of gold, making it a versatile and manageable addition to their portfolios.

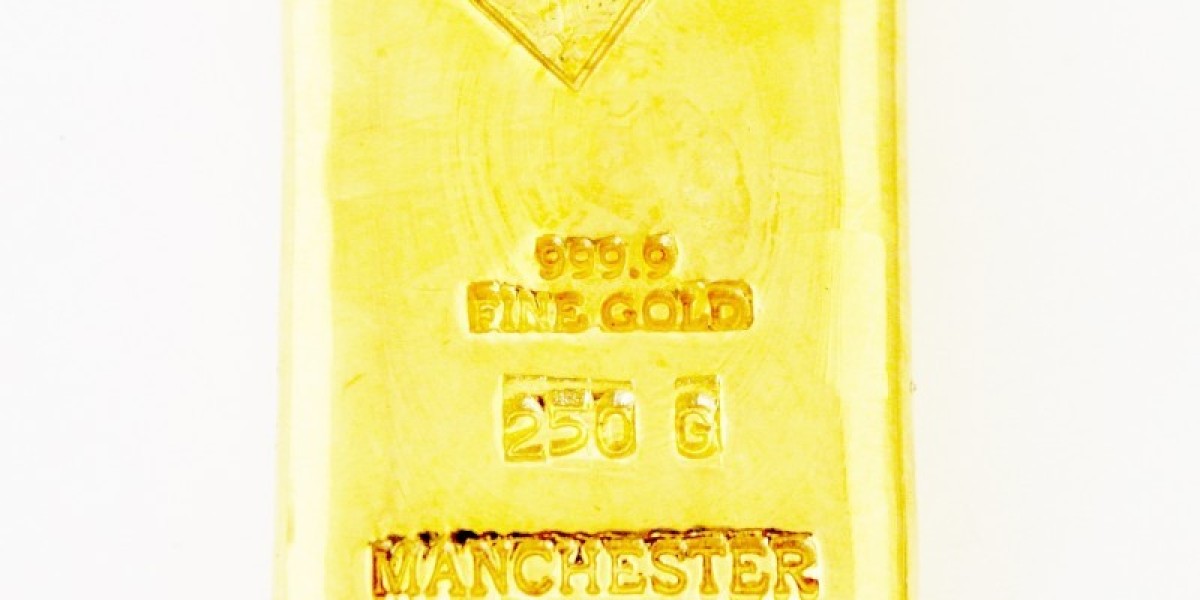

Purity and Authenticity:

Purity is a critical factor in any gold investment, and the 250g gold bar typically boasts high purity levels. Reputable mints and refineries globally produce these bars with purity levels often exceeding 99.9%. The assurance of authenticity is further strengthened by unique serial numbers and the reputation of the mint, ensuring investors receive a product of exceptional quality and value.

Liquidity and Marketability:

The 250g gold bar benefits from its liquidity in the precious metals market. While smaller bars may be more liquid, they might lack the same substantial value as larger bars. The 250g gold bar strikes a harmonious balance, offering both significant value and increased marketability. This makes it an attractive choice for investors who value both the ease of buying and selling in the market.

Storage and Practicality:

Owning physical gold comes with the responsibility of secure storage. The 250g gold bar, with its moderate size, allows for more practical and convenient storage options compared to larger bars. Investors can choose secure vaults, private safe deposit boxes, or even home safes for storing their valuable assets without the logistical challenges associated with larger gold bars.

Diversification and Risk Mitigation:

Diversification is a cornerstone of effective investment strategies, and gold 250g gold bar plays a crucial role in mitigating risks associated with other financial assets. The 250g gold bar provides investors with the opportunity to diversify their portfolios without the need for excessive capital outlay. Its size makes it a feasible option for both seasoned investors and those entering the world of gold investments.

Conclusion:

In the dynamic landscape of financial markets, the 250g gold bar shines as a pragmatic and versatile choice for investors. Its optimal balance between size, purity, and marketability makes it an attractive addition to diversified portfolios. Whether chosen for its stability as a safe-haven asset or for its potential for capital appreciation, the 250g gold bar stands as a symbol of enduring value in the world of precious metal investments.