Quick monetary assistance loans play a crucial position in trendy financial management. They handle immediate financial wants, serving to individuals and families cope with surprising bills.

Quick monetary assistance loans play a crucial position in trendy financial management. They handle immediate financial wants, serving to individuals and families cope with surprising bills. For occasion, a sudden automobile repair or an emergency medical bill can strain a family price range. Quick loans can bridge the gap, guaranteeing that individuals can manage these expenses with out resorting to more detrimental monetary decisions.

Payday loans can provide a lifeline for freelancers going through surprising monetary challenges, but they should be approached cautiously. Understanding their performance, implications, and potential alternate options is essential for making knowledgeable monetary decisions. Freelancers are encouraged to evaluate their monetary conditions, set up budgets, and prioritize the development of emergency savings funds. Ultimately, whereas payday loans can be a momentary fix, the objective should at all times be to construct a steady financial future free from reliance on high-interest debt.

Using fast monetary help loans can significantly influence a borrower’s credit score score, depending on how repayments are managed. Timely repayments might help improve credit scores, demonstrating financial responsibility. Conversely, late funds or defaults can result in a big drop in credit score rankings.

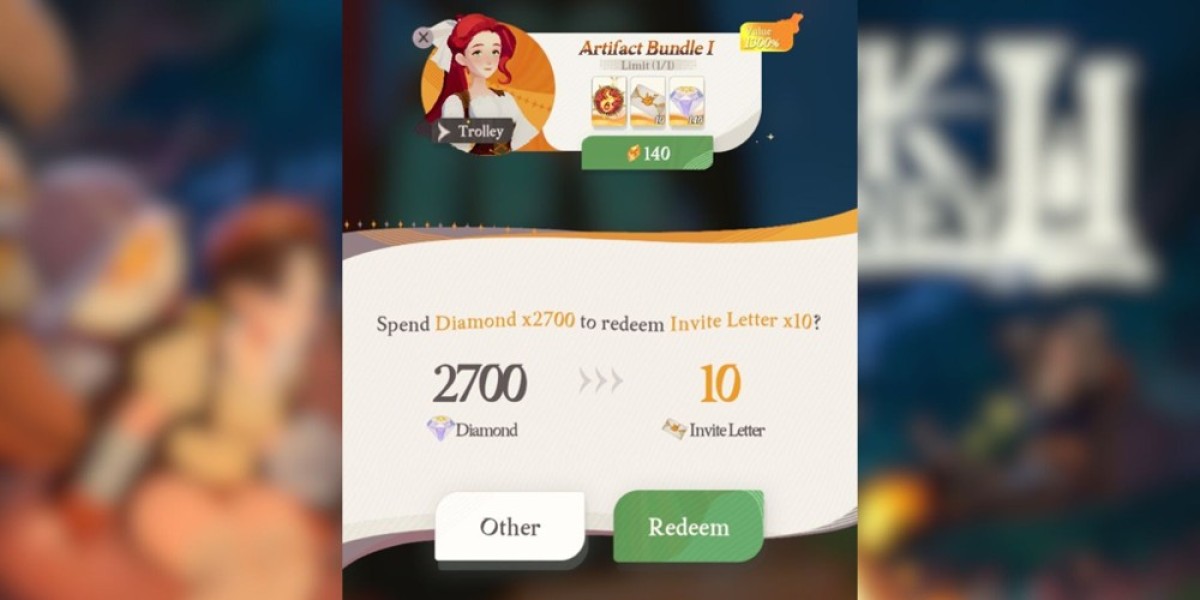

Payday loans are short-term, high-interest loans typically due on the borrower's subsequent payday. These loans are sometimes used to cover surprising bills or to bridge gaps between paychecks. Unlike traditional loans that require a credit score check and intensive documentation, payday loans are generally simpler to acquire and can be secured quickly, generally inside hours. For freelancers, who typically expertise fluctuations in revenue, these loans can present instant monetary reduction throughout powerful months.

Moreover, there is a perception that fast loans result in unmanageable debt. While this can be true if debtors don't manage their finances prudently, these loans can function priceless instruments when used responsibly. Many consumers can meet their emergency needs and repay the loans with out adverse penalties, underlining the importance of understanding one’s monetary state of affairs before borrowing.

The significance of understanding cash loans for emergencies can't be overstated. While they'll present essential funding during important times, borrowers must navigate the choices rigorously and be aware of the implications of those loans. By recognizing the forms of loans out there, understanding eligibility criteria, and weighing the dangers, individuals could make knowledgeable choices that align with their monetary conditions. Exploring options and getting ready for emergencies can even interact positively with the stress of surprising expenses. Ultimately, the data gained from this exploration empowers people to take control of their monetary well being and seek the best path forward throughout challenging occasions.

Despite their benefits, unsecured loans online come with certain drawbacks that potential borrowers ought to be conscious of. First and foremost is the higher interest rates. Because these loans are unsecured, lenders take on a higher threat, typically leading to elevated costs for the borrower. In some instances, interest rates can exceed 30%, especially for people with decrease credit scores. Additionally, failure to repay an unsecured mortgage can severely harm your credit standing since these loans sometimes report again to credit score bureaus. Lastly, debtors might face hidden charges or unfavorable mortgage phrases that may escalate the general price of the

Loan for Day Laborers, emphasizing the need for thorough analysis and due diligence before committing.

Before applying for a web-based

Non-Visit Loan, there are a quantity of preparation steps to enhance the likelihood of approval and favorable terms. Start by checking your credit score report for errors and making certain your credit rating displays your financial history accurately. Consider paying down current debts to enhance your debt-to-income ratio. Gather essential documents, such as proof of income, employment details, and some other financial info which might be required through the software course of. Knowing the amount you wish to borrow and the purpose of the mortgage can also make the appliance smoother. By being organized and informed, you enhance your possibilities of a seamless utility experience.

Cash loans for emergencies are short-term financial solutions designed to supply immediate funds when people face urgent monetary situations. These loans can cowl surprising expenses such as medical bills, car repairs, or urgent home maintenance. They are sometimes unsecured, meaning borrowers don't want to supply collateral. The utility course of is generally swift, typically allowing funds to be accessed within one business day. According to a examine by the Federal Reserve, around 40% of Americans are unable to deal with a $400 emergency expense with out borrowing or selling one thing. This statistic highlights the prevalence of economic instability and the need for instruments like money loans.

Navigating the Road to Legality: Why "Buying" a Driver's License is a Dangerous Illusion

کی طرف سے fuehrerscheinn3756

Navigating the Road to Legality: Why "Buying" a Driver's License is a Dangerous Illusion

کی طرف سے fuehrerscheinn3756 How Slot Strategies Has Become The Top Trend On Social Media

کی طرف سے rainbet7946

How Slot Strategies Has Become The Top Trend On Social Media

کی طرف سے rainbet7946 Top 10 Features You Can Gain Access To After Registering with Bet9ja Promo Code YOHAIG

کی طرف سے rosiepennefath

Top 10 Features You Can Gain Access To After Registering with Bet9ja Promo Code YOHAIG

کی طرف سے rosiepennefath Betting's Multi-Billion War: Industry Leaders Face Double Challenge in Nigeria

کی طرف سے tarahruhl84656

Betting's Multi-Billion War: Industry Leaders Face Double Challenge in Nigeria

کی طرف سے tarahruhl84656 Bet9ja Repayment Techniques Overview: Just How to Down payment and Withdraw After Using Promo Code YOHAIG

کی طرف سے alphonseu90578

Bet9ja Repayment Techniques Overview: Just How to Down payment and Withdraw After Using Promo Code YOHAIG

کی طرف سے alphonseu90578