Within the realm of retirement planning, traders are always searching for ways to diversify their portfolios and protect their assets towards market volatility and inflation. One choice that has gained reputation lately is the IRA gold account. This specialized account permits individuals to spend money on physical gold and different valuable metals as a part of their retirement savings strategy. In this text, we will explore the advantages and issues list of gold ira companies an IRA gold account, offering a comprehensive understanding of its position in retirement planning.

Understanding IRA Gold Accounts

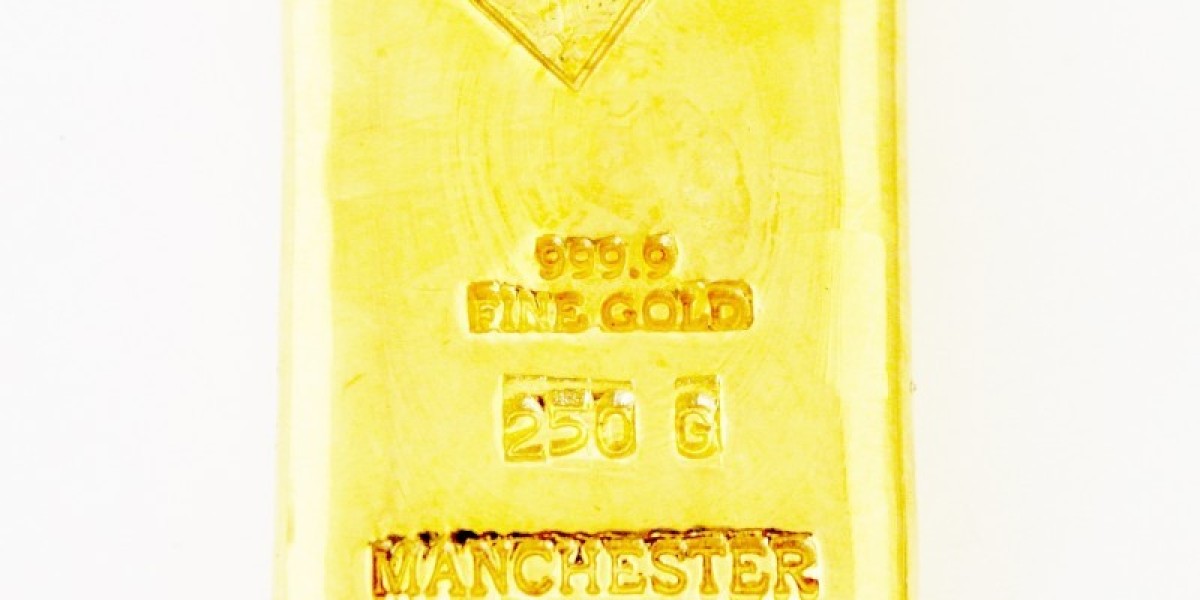

An IRA gold account is a sort of self-directed Particular person Retirement Account (IRA) that permits the inclusion of bodily gold and different precious metals as investment property. Unlike traditional IRAs, which sometimes consist of stocks, bonds, and mutual funds, a gold IRA permits for the acquisition of bullion, coins, and different treasured steel products. The sort of funding can serve as a hedge against inflation and financial uncertainty, making it a gorgeous possibility for a lot of buyers.

The advantages of an IRA Gold Account

- Inflation Hedge: One in all the primary causes individuals consider investing in gold is its historical performance as a hedge towards inflation. When the value of fiat currencies declines, gold usually retains its worth or appreciates, making it a dependable store of wealth over time.

- Diversification: A gold IRA gives a possibility to diversify an funding portfolio. By including bodily gold, traders can scale back their exposure to market fluctuations and improve the general stability of their retirement savings. This diversification may be notably useful throughout intervals of economic instability.

- Tangible Asset: In contrast to stocks or bonds, gold is a tangible asset that investors can bodily possess. This intrinsic value can present peace of thoughts, especially during occasions of financial disaster. Moreover, the bodily nature of gold means it is not subject to the same risks as digital belongings or paper investments.

- Tax Advantages: Like conventional IRAs, gold IRAs offer tax-deferred growth. Which means buyers don't must pay taxes on the good points made within the account until they withdraw funds during retirement. Furthermore, if the account is a Roth IRA, certified withdrawals could also be tax-free.

- Safety from Economic Uncertainty: Gold has traditionally been considered as a safe haven asset during times of economic turmoil. When geopolitical tensions rise or financial markets grow to be unstable, buyers often flock to gold ira companies qualified, driving up its worth. This characteristic makes gold an interesting possibility for these trying to guard their retirement savings.

Considerations When Opening an IRA Gold Account

While there are quite a few benefits to investing in a gold IRA, there are also a number of considerations that potential traders should keep in thoughts:

- Custodianship: Gold IRAs require a custodian to handle the account and hold the physical gold. Not all custodians supply gold IRAs, so buyers must choose one that specializes in precious metals. This will likely contain extra fees and due diligence to ensure the custodian is respected and compliant with IRS regulations.

- Storage Costs: Storing physical gold ira companies rating comes with related prices. Buyers should consider the charges for safe storage, which may fluctuate relying on the custodian and the quantity of gold ira companies compared - northwaveasia.com, held. Some custodians might offer segregated storage, whereas others might pool belongings, impacting storage fees and safety.

- Limited Investment Choices: While a gold IRA provides the opportunity to spend money on precious metals, it could limit the power to spend money on different asset lessons. This could result in a less diversified portfolio total if the majority of retirement savings are allotted to gold.

- Market Volatility: Though gold is usually seen as a safe haven, its value can nonetheless be subject to vital fluctuations. Traders must be prepared for the potential of quick-time period volatility and understand that previous efficiency is just not indicative of future results.

- Regulatory Compliance: The IRS has particular laws concerning the varieties of gold and valuable metals that can be included in an IRA. Solely sure coins and bullion that meet minimum purity standards are eligible. Traders must be certain that their purchases adjust to IRS pointers to avoid penalties or disqualification of the account.

Learn how to Open an IRA Gold Account

Opening an IRA gold account entails a number of steps:

- Choose a Custodian: Research and select a custodian that specializes in gold IRAs. Make sure that they have a solid reputation, transparent price buildings, and a transparent understanding of IRS rules.

- Fund the Account: Buyers can fund their gold IRA via a rollover from an present retirement account, a direct switch, or by making a new contribution. Be aware of contribution limits and tax implications.

- Choose Valuable Metals: Work with the custodian to choose the precise gold and precious metals to include in the account. Be certain that the selected assets meet IRS necessities for purity and eligibility.

- Storage Arrangements: Decide the storage choices accessible by means of the custodian. Resolve whether to opt for segregated or pooled storage and understand the associated prices.

- Monitor the Investment: Often overview the performance of the gold IRA and keep informed about market trends. Alter the funding technique as needed to align with retirement targets.

Conclusion

An IRA gold account could be a valuable addition to a diversified retirement portfolio, providing unique advantages such as inflation safety, tangible asset ownership, and tax advantages. However, it is crucial for investors to rigorously consider the related prices, regulatory necessities, and market volatility. By understanding both the advantages and considerations of a gold IRA, people could make informed choices that align with their long-time period financial objectives and retirement plans. As with any funding, conducting thorough research and consulting with monetary professionals can assist ensure a successful technique for incorporating gold into retirement financial savings.