In recent times, the financial panorama has experienced a major transformation, with investors increasingly seeking different avenues to safeguard and grow their wealth. Among these alternate options, Individual Retirement Accounts (IRAs) backed by precious metals, notably gold, have gained considerable traction. This observational research article explores the emergence of IRA gold accounts, examining the underlying motivations, investor conduct, and the broader implications for the monetary market.

The idea of investing in gold by way of IRAs just isn't new; however, its popularity has surged within the wake of financial uncertainties, inflation fears, and geopolitical tensions. When you loved this short article and you wish to receive details regarding top-rated companies for ira gold rollover kindly visit our own page. Buyers are drawn to gold as a hedge against inflation and foreign money fluctuations, perceiving it as a safe haven during turbulent times. Observations indicate that the current global economic challenges, together with the COVID-19 pandemic and supply chain disruptions, have additional fueled interest in precious metals as a reliable options for retirement gold-backed investments retailer of value.

A key factor contributing to the rise of IRA gold accounts is the increasing awareness of the benefits of diversifying investment portfolios. Conventional retirement accounts, primarily composed of stocks and bonds, can expose buyers to important dangers during market downturns. In contrast, gold has traditionally shown a detrimental correlation with equities, making it a sexy choice for those searching for to mitigate risk. As such, many monetary advisors now recommend together with a share of precious metals in retirement portfolios, leading to a surge within the institution of gold-backed IRAs.

The demographic profile of traders choosing IRA gold accounts reveals attention-grabbing developments. A significant portion of these investors falls inside the 35 to 55 age vary, often characterized by a heightened sense of financial duty and a need for lengthy-term safety. This demographic is more and more savvy about financial markets, with many having experienced the repercussions of the 2008 financial disaster. Observational data recommend that these investors prioritize asset protection and wealth preservation, viewing gold as a tangible asset that can withstand financial fluctuations.

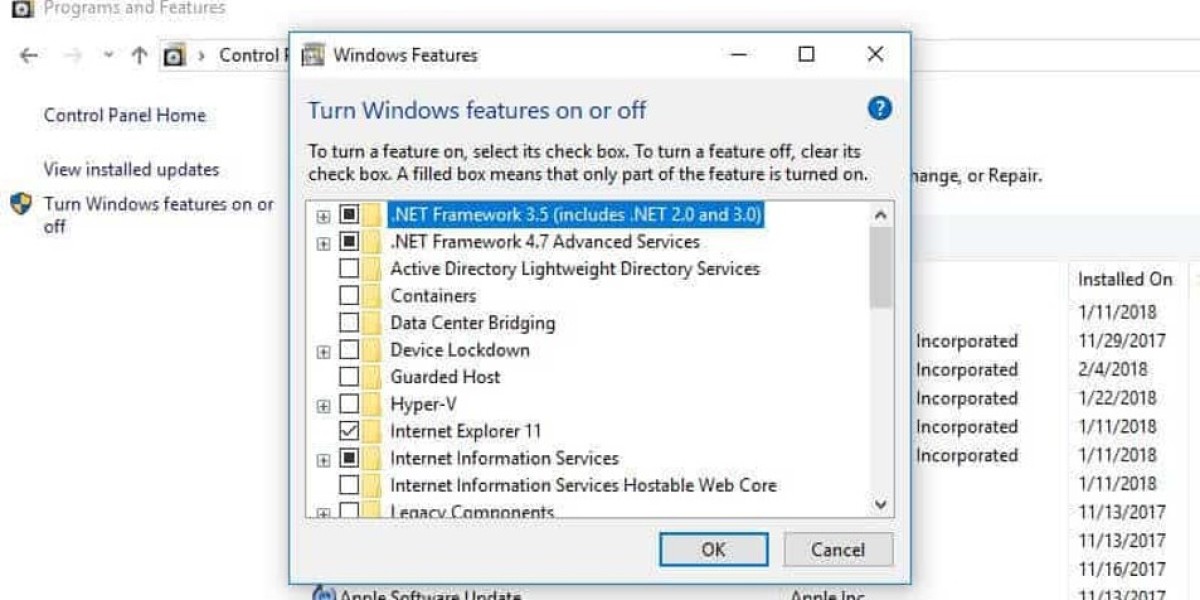

Moreover, the technological advancements in the monetary sector have facilitated the growth of IRA gold accounts. Online platforms and investment trusted firms for gold-backed ira specializing in valuable metals have made it easier for individuals to arrange and handle their accounts. The accessibility of data concerning the performance of gold as an funding has empowered consumers to make informed choices. Many investors now conduct in depth research online, evaluating totally different gold IRA suppliers, fees, and trusted companies for ira investments earlier than committing to a particular account. This shift in the direction of digital engagement reflects a broader trend in shopper conduct, with a growing emphasis on transparency and ease of entry.

The process of establishing an IRA gold account usually involves a number of steps, together with selecting a custodian, choosing the type of gold to spend money on, and funding the account. Observational data reveal that many investors choose to work with reputable custodians who specialise in treasured metals, as this adds a layer of security and experience to their investments. Additionally, investors often gravitate in the direction of gold bullion coins and bars, that are acknowledged for their purity and liquidity. The U.S. Mint’s American Eagle and Canadian Maple Leaf coins are amongst the most popular selections, as they're widely accepted and valued out there.

Regardless of the benefits of IRA gold accounts, potential traders must also be aware of the associated risks and challenges. One notable concern is the volatility of gold prices, which might fluctuate based mostly on varied elements, including financial indicators, interest charges, and world occasions. Observations indicate that whereas gold is often seen as a stable funding, it could possibly expertise durations of significant value swings, which can affect the overall worth of an IRA gold account. Therefore, buyers are encouraged to approach gold funding with a protracted-term perspective, understanding that brief-time period fluctuations are a part of the market dynamics.

Regulatory issues additionally play a crucial function within the institution and management of IRA gold accounts. The internal Income Service (IRS) has particular guidelines relating to the kinds of gold and different valuable metals that can be held in an IRA. Observational insights counsel that many investors might not totally perceive these regulations, resulting in potential compliance points. It is essential for buyers to work closely with experienced custodians and financial advisors to ensure that their investments meet IRS requirements, thereby avoiding penalties and maintaining the tax-advantaged status of their accounts.

As the popularity of IRA gold accounts continues to develop, so too does the emergence of associated financial services and products. Funding companies are increasingly offering gold-backed ETFs (change-traded funds) and mutual funds, offering investors with additional options for gaining exposure to gold without the need for bodily storage. Observational knowledge point out that these products enchantment to a broader range of traders, including those that may be hesitant to take on the duties related to holding physical gold.

In conclusion, the rise of IRA gold accounts reflects a rising trend among traders seeking to diversify their portfolios and protect their wealth in an unpredictable economic surroundings. The motivations driving this trend embrace a desire for asset safety, the influence of technological advancements, and a shift in consumer conduct in the direction of informed choice-making. While IRA gold accounts offer numerous benefits, potential investors must stay vigilant about the related risks and regulatory concerns. Because the financial landscape continues to evolve, the role of gold as a strategic funding possibility is probably going to remain important, shaping the future of retirement planning and wealth management.