The concept of transferring a person Retirement Account (IRA) to gold investments has gained traction lately, particularly among investors looking for to diversify their portfolios and hedge against financial uncertainties. This study report goals to provide an in depth overview of the process, advantages, risks, and concerns involved in transferring an IRA to gold.

Introduction

A person Retirement Account (IRA) is a well-liked retirement financial savings vehicle that provides tax advantages. Conventional IRAs typically invest in stocks, bonds, and mutual funds. However, there's an rising interest in self-directed IRAs, which allow for a broader range of funding choices, together with treasured metals like gold. This report will explore the mechanics of transferring an IRA to gold, the rationale behind this investment technique, and the implications for buyers.

Understanding Gold IRAs

Gold IRAs are a sort of self-directed IRA that enables investors to hold bodily gold and other top-rated precious metals iras metals within their retirement accounts. The inner Income Service (IRS) regulates the sorts of metals that may be included, and so they must meet particular purity requirements. Eligible metals include:

- Gold bullion and coins (e.g., American Gold Eagle, Canadian Gold Maple Leaf)

- Silver bullion and coins

- Platinum and palladium bullion

The Process of Transferring an IRA to Gold

Transferring an IRA to gold involves a number of steps:

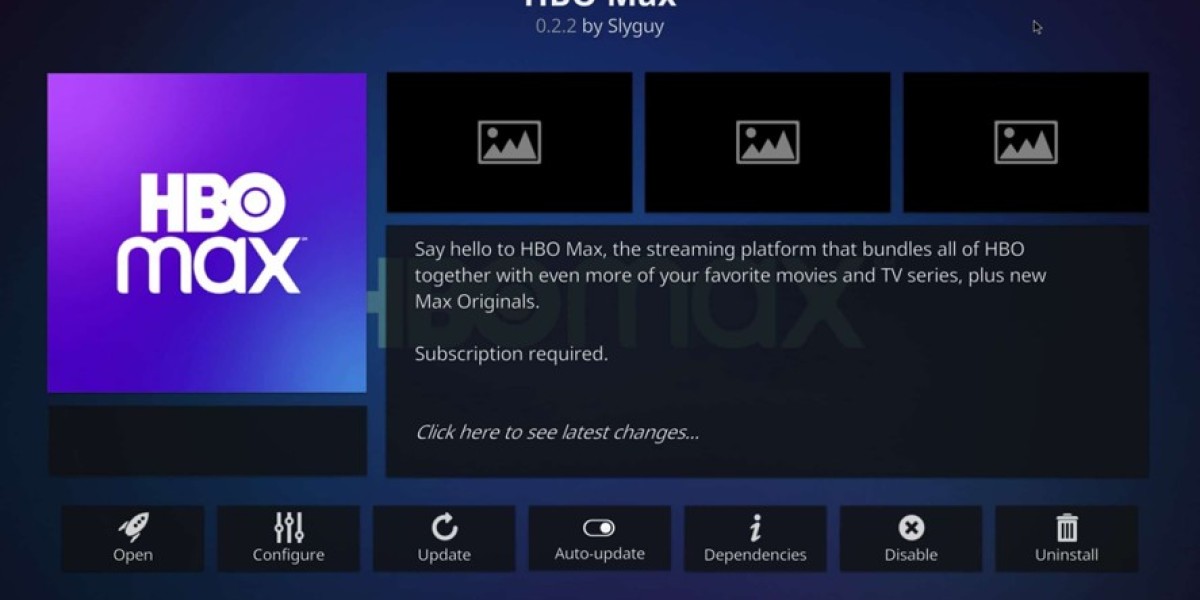

- Choose a Self-Directed IRA Custodian: Step one is to pick out a custodian that enables for investments in treasured metals. Not all custodians supply this service, so it is crucial to conduct thorough analysis and choose a reputable supplier.

- Open a Gold IRA Account: As soon as a custodian is selected, the investor should open a self-directed IRA account specifically for gold investments. This course of typically includes filling out an utility and offering vital documentation.

- Fund the Gold IRA: Investors can fund their new Gold IRA by means of a direct transfer from an existing IRA or by rolling over funds from a certified retirement plan. It is crucial to observe IRS pointers to avoid tax penalties.

- Choose Gold Investments: After funding the account, the investor can choose which gold products to buy. The custodian will facilitate the acquisition and make sure that the metals meet IRS requirements.

- Storage of Gold: The IRS requires that physical gold is saved in an accredited depository. If you are you looking for more in regards to best gold ira firms in the usa check out our own web site. The custodian will help in arranging secure storage, which is essential for maintaining the account's tax-advantaged status.

Benefits of Transferring IRA to Gold

- Hedge Against Inflation: Gold has historically been considered as a secure-haven asset throughout occasions of financial uncertainty and inflation. Because the purchasing power of fiat currencies declines, gold tends to retain its worth.

- Portfolio Diversification: Including gold to an investment portfolio can improve diversification. Gold typically has a low correlation with traditional assets like stocks and bonds, which may reduce total portfolio risk.

- Tax Advantages: Gold IRAs offer the same tax advantages as conventional IRAs. Contributions could also be tax-deductible, and investment good points can grow tax-deferred until withdrawal.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that can be held and stored. This tangibility can present peace of thoughts for buyers involved about market volatility.

Risks and Concerns

- Market Volatility: Whereas gold is usually seen as a stable investment, it's not immune to price fluctuations. Investors must be ready for the potential for vital worth swings.

- Storage and Insurance Costs: Storing bodily gold can incur additional costs, including storage charges and insurance. These expenses can eat into investment returns.

- Restricted Development Potential: In contrast to stocks, gold does not generate earnings through dividends or interest. Its worth is primarily pushed by market demand and provide, which can restrict growth potential in comparison with equities.

- Regulatory Compliance: Traders should guarantee compliance with IRS laws relating to gold IRAs. Failure to adhere to these rules can result in penalties and taxes.

Conclusion

Transferring an IRA to gold can be a strategic transfer for buyers searching for to diversify their retirement portfolios and protect towards financial uncertainties. The method involves selecting a good custodian, opening a self-directed IRA, and buying eligible gold investments whereas making certain compliance with IRS rules.

While there are notable advantages, including inflation hedging and portfolio diversification, buyers must additionally consider the associated risks and prices. Finally, a nicely-knowledgeable decision, guided by thorough analysis and professional recommendation, can lead to a successful transition to gold investments within an IRA.

Suggestions

For those considering a transfer of their IRA to gold, it is advisable to:

- Conduct intensive research on potential custodians and their charges.

- Consult with a monetary advisor who specializes in valuable metals and retirement planning.

- Stay informed about market developments and gold value movements.

- Usually review the performance of the gold investment inside the general retirement strategy.