Lately, gold has emerged as a well-liked funding selection, particularly for these seeking to secure their retirement financial savings. With the volatility of the stock market and issues about inflation, many traders are turning to gold as a protected haven. One among the best methods to spend money on gold is thru a Gold Individual Retirement Account (IRA). A Gold IRA allows individuals to hold physical gold and different valuable metals in a tax-advantaged retirement account. This article will discover the technique of transferring an present retirement account to a Gold IRA, the advantages of such a switch, and important considerations to keep in mind.

Understanding Gold IRAs

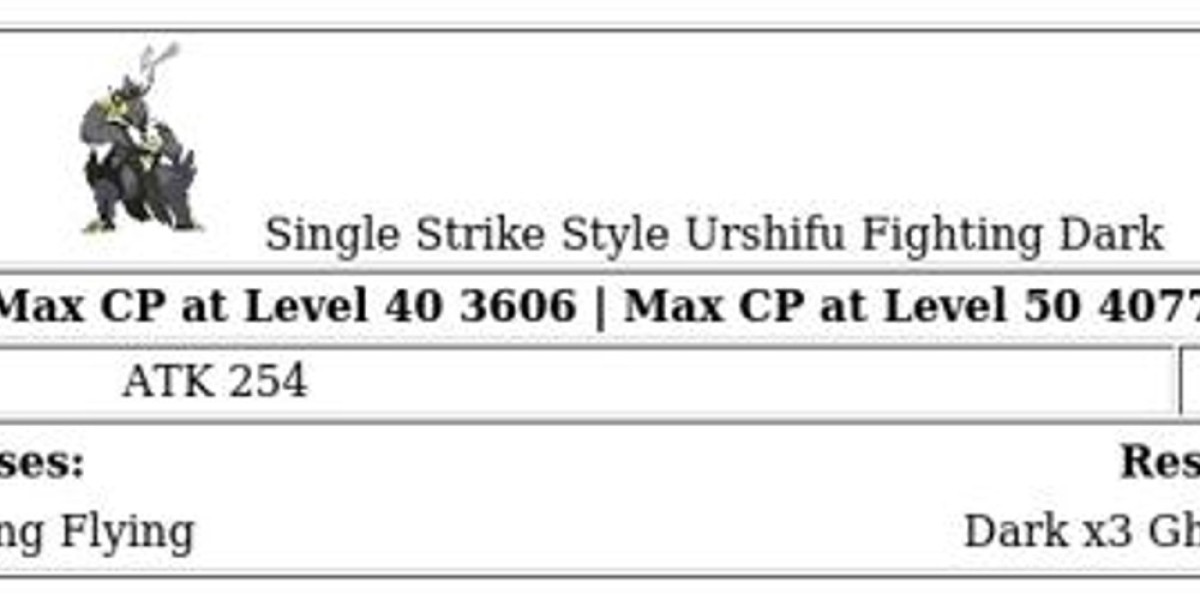

A Gold IRA is a sort of self-directed IRA that allows traders to incorporate physical gold, silver, platinum, and palladium of their retirement portfolios. Unlike conventional IRAs that typically hold stocks, bonds, and mutual funds, Gold IRAs provide the unique benefit of tangible assets that may act as a hedge in opposition to inflation and economic uncertainty. The internal Revenue Service (IRS) has specific regulations regarding the sorts of metals that can be held in a Gold IRA, guaranteeing that solely certain purity levels and authorised coins or bars are eligible.

The need for a Gold IRA Transfer

Buyers may select to transfer their existing retirement accounts—such as a standard IRA, Roth IRA, or 401(okay)—to a Gold IRA for a number of causes:

- Protection Against Market Volatility: Gold has historically maintained its worth throughout financial downturns, making it a beautiful option for these concerned about market fluctuations.

- Inflation Hedge: As inflation rises, the purchasing energy of cash and conventional investments could decline. Gold has been viewed as a dependable retailer of worth that might help preserve wealth.

- Diversification: Adding gold to a retirement portfolio can enhance diversification, doubtlessly reducing overall danger and improving returns.

- Tax Advantages: Transferring to a Gold IRA permits buyers to take care of tax-deferred progress on their investments, much like traditional IRAs.

The Gold IRA Transfer Course of

Transferring an existing retirement account to a Gold IRA includes several key steps:

1. Research and Choose a Custodian

Step one in the transfer process is to select a good custodian that makes a speciality of Gold IRAs. The IRS requires that all IRAs be held by a professional custodian, who will handle the account and ensure compliance with laws. When choosing a custodian, consider elements reminiscent of fees, customer service, storage options, and their experience with treasured metals.

2. Open a Gold IRA Account

After getting chosen a custodian, the next step is to open a Gold IRA account. This typically includes filling out an software form and providing necessary documentation, reminiscent of identification and proof of existing retirement accounts. Your custodian will information you thru this course of and ensure that each one paperwork is completed accurately.

3. Provoke the Transfer

After your Gold IRA account is established, you can provoke the transfer of funds from your existing retirement account. That is usually carried out via a direct switch or rollover. In a direct transfer, the funds are moved straight from the previous account to the brand new Gold IRA with out the account holder taking possession of the money. This method helps keep away from tax penalties and ensures a smooth transition.

Within the case of a rollover, the account holder receives a examine made out to themselves and must deposit it into the Gold IRA inside 60 days to avoid tax penalties. It is necessary to note that just one rollover is allowed per 12 months for IRAs, so careful planning is crucial.

4. Purchase Gold and Different Precious Metals

As soon as the funds are successfully transferred into your Gold IRA, you'll be able to start buying eligible treasured metals. Your custodian will provide you with a list of gold ira companies of accepted coins and bars that can be held in the account. It’s crucial to ensure that all purchases comply with IRS laws regarding purity and type.

5. Safe Storage

Bodily gold and other precious metals held in a Gold IRA should be stored in an accepted depository. Your custodian will sometimes have partnerships with safe storage amenities the place your metals shall be kept. The IRS mandates that you can not take possession of the metals while they're held in an IRA, as this is able to result in a taxable event.

Advantages of Transferring to a Gold IRA

Transferring to a Gold IRA gives a number of advantages:

- Wealth Preservation: Gold has a protracted-standing repute as a dependable asset for wealth preservation, especially during turbulent financial times.

- Tax Advantages: By sustaining a tax-advantaged account, investors can benefit from tax-deferred progress on their gold investments.

- Control and flexibility: A self-directed Gold IRA allows buyers to have more management over their investment choices, enabling them to diversify their portfolios in response to their danger tolerance and financial objectives.

- Long-Term Value: Traditionally, gold has appreciated over the long run, making it a probably lucrative funding for retirement.

Necessary Issues

Whereas a Gold IRA transfer may be a wonderful strategy for retirement planning, there are important components to think about:

- Charges: Gold IRAs could have increased charges than traditional IRAs due to storage, insurance, and management costs. Ensure to know all related fees earlier than proceeding.

- Market Danger: Though gold is usually considered as a safe haven, it's not immune to market fluctuations. Buyers ought to bear in mind of the dangers concerned in holding bodily gold.

- IRS Rules: Compliance with IRS rules is essential to avoid penalties. Make sure that your custodian is educated about the rules governing gold ira companies rated IRAs.

- Investment Horizon: Gold is typically thought-about a protracted-time period funding. Buyers ought to assess their financial objectives and time horizon before making a transfer.

Conclusion

A Gold IRA transfer generally is a strategic move for investors seeking to diversify their retirement portfolios and protect their financial savings from market volatility and inflation. By understanding the process and advantages of transferring to a Gold IRA, people can make knowledgeable selections that align with their long-term monetary objectives. As with all investment, it is crucial to conduct thorough analysis and consult with monetary professionals to make sure that a Gold IRA is the correct choice for your retirement strategy.