Lately, gold has emerged as a significant funding vehicle for people looking to diversify their retirement portfolios. Gold Particular person Retirement Accounts (IRAs) provide buyers a novel alternative to carry physical gold and different treasured metals in a tax-advantaged account. This case examine explores the basics of Gold IRA investing, its advantages, potential drawbacks, and an actual-life example of an investor's journey into the world of gold investments.

Understanding Gold IRAs

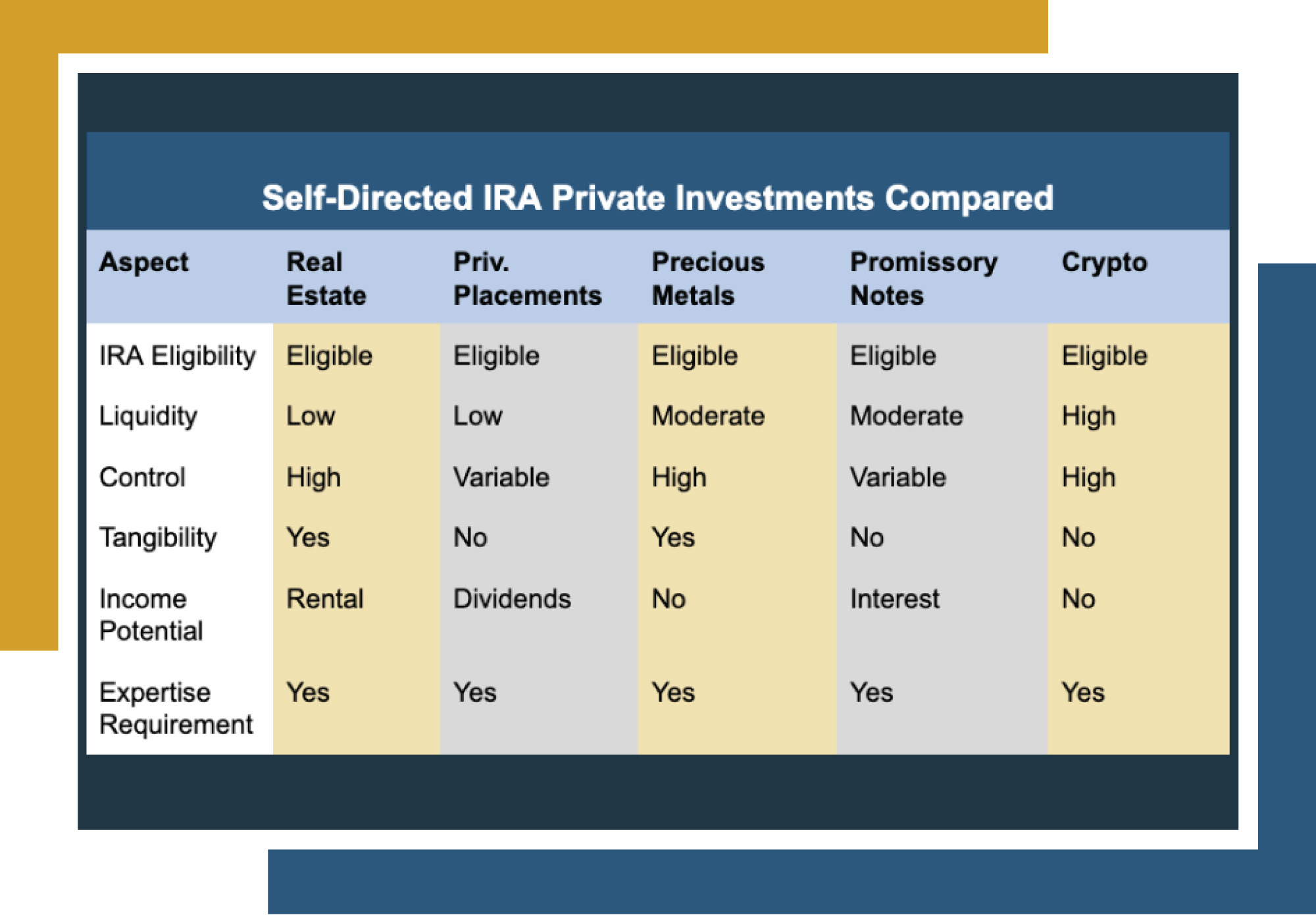

A Gold IRA is a kind of self-directed individual retirement account that allows buyers to hold physical gold, silver, platinum, and palladium as part of their retirement portfolio. Not like traditional IRAs that sometimes hold stocks, bonds, or mutual funds, Gold IRAs present publicity to the precious metals market, which might serve as a hedge towards inflation and financial downturns.

The internal Income Service (IRS) has particular rules governing Gold IRAs. To qualify, the gold must meet sure purity requirements (e.g., 99.5% for gold) and must be stored in an approved depository. Buyers cannot keep the bodily gold at dwelling, as this might violate IRS rules.

Advantages of Gold IRA Investing

- Inflation Hedge: Gold has traditionally maintained its worth throughout periods of inflation. As the purchasing energy of fiat currencies declines, gold often appreciates, offering a safeguard for retirement savings.

- Diversification: Including gold in a retirement portfolio can diversify danger. Treasured metals often move independently of stocks and bonds, which may help stabilize general portfolio performance.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that may be held and saved. This tangibility can provide peace of thoughts for buyers concerned about economic instability or market volatility.

- Tax Benefits: Gold IRAs supply the same tax advantages as conventional IRAs. Contributions may be tax-deductible, and positive factors on investments develop tax-deferred till withdrawal.

Potential Drawbacks

- Storage and Insurance coverage Prices: Holding physical gold requires safe storage and insurance coverage, which can add to the general price of investing in a Gold IRA.

- Limited Liquidity: Promoting bodily gold can take time, and traders might face challenges find buyers or reaching favorable costs.

- Market Volatility: While gold is usually seen as a secure retirement options with gold haven, its value might be volatile within the quick time period, influenced by financial factors, geopolitical occasions, and investor sentiment.

- Regulatory Compliance: Buyers must navigate IRS rules and ensure that their Gold IRA meets all necessities, which may be complicated and time-consuming.

A real-Life Case Examine: John’s Gold IRA Journey

John, a 55-12 months-previous financial planner, decided to explore Gold IRA investing after witnessing the impact of economic uncertainty on his clients’ portfolios. Involved about inflation and market volatility, he wanted to diversify his retirement savings and protect his wealth.

Step 1: Analysis and Schooling

John began by educating himself about Gold IRAs. He learn articles, attended webinars, and consulted with monetary advisors specializing in treasured metals. He discovered in regards to the forms of gold that qualify for IRAs, the significance of choosing a good custodian, and the logistics of storage.

Step 2: Selecting a Custodian

After thorough research, John chosen a custodian that specialized in Gold IRAs. He in contrast charges, buyer critiques, and customer service. In the end, he selected a custodian with a strong reputation and transparent payment construction.

Step 3: Opening the Gold IRA

John opened a self-directed Gold IRA account together with his chosen custodian. He funded the account via a mix of a rollover from his current traditional IRA and a money contribution. This process involved filling out forms and ensuring compliance with IRS rules.

Step 4: Selecting Gold Investments

With the assistance of his custodian, John selected a mix of gold bullion coins and bars that met IRS purity requirements. He opted for effectively-known merchandise like American Gold Eagles and Canadian Gold Maple Leafs. The custodian facilitated the purchase and ensured the gold was stored in an authorised depository.

Step 5: Monitoring and Adjusting

John commonly monitored his Gold IRA’s performance and stayed informed about market tendencies. He appreciated the stability that gold supplied throughout financial downturns and adjusted his general funding strategy accordingly. He additionally maintained open communication with his custodian to ensure his investments remained compliant with IRS laws.

Outcomes and Reflections

After 5 years, John’s Gold IRA had appreciated significantly, offering him with a sense of security as he approached retirement. The diversification benefits were evident, as his gold holdings carried out well even when traditional stock markets faced challenges. John felt confident that his investment in gold would serve as a dependable hedge against inflation and financial uncertainty.

Reflecting on his journey, John emphasised the importance of training and due diligence within the Gold IRA investment course of. He suggested potential buyers to totally research custodians, understand the prices involved, and consider their long-time period monetary objectives earlier than committing to a Gold IRA.

Conclusion

Investing in a Gold IRA generally is a strategic transfer for individuals trying to diversify their retirement portfolios and safeguard their wealth towards economic uncertainties. Whereas there are advantages and potential drawbacks to think about, the case examine of John illustrates how informed decision-making and cautious planning can lead to profitable outcomes. As with any funding, individuals ought to conduct thorough analysis and seek the advice of with monetary professionals to make sure that Gold IRAs align with their total retirement strategy.