In an period of financial uncertainty and fluctuating markets, individuals are increasingly wanting for ways to safe their financial future. One funding automobile that has gained important consideration is the person Retirement Account (IRA) backed by gold and other treasured metals. IRA gold accounts provide a novel mix of safety and progress potential, making them a gorgeous option for retirement planning. This text explores the fundamentals of IRA gold accounts, their benefits, potential drawbacks, and how you can get started.

Understanding IRA Gold Accounts

An recommended ira companies for gold-backed retirement gold account is a sort of self-directed individual retirement account that allows traders to carry bodily gold and different valuable metals as part of their retirement portfolio. In contrast to traditional IRAs, which sometimes consist of stocks, bonds, and mutual funds, gold IRAs provide a tangible asset that can act as a hedge in opposition to inflation and financial downturns. The inner Revenue Service (IRS) has particular regulations governing the sorts of precious metals that may be held in these accounts, including gold, silver, platinum, and palladium, provided they meet certain purity standards.

Benefits of IRA Gold Accounts

- Inflation Hedge: One of the first advantages of investing in gold is its historic potential to retain value during inflationary durations. As the buying power of fiat currencies declines, gold usually appreciates, making it an effective hedge towards inflation.

- Diversification: Gold accounts can diversify an investment portfolio, decreasing total threat. By allocating a portion of retirement financial savings to gold, traders can mitigate losses from traditional asset lessons during market volatility.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that traders can hold. This tangibility can provide peace of mind, especially during occasions of financial instability when digital assets may seem less safe.

- Tax Advantages: Like conventional IRAs, gold IRAs offer tax advantages. Contributions could also be tax-deductible, and the expansion of investments within the account is tax-deferred until withdrawals are made throughout retirement.

- International Acceptance: Gold is recognized and valued worldwide, making it a universally accepted asset. This global acceptance can present liquidity and ease of transaction sooner or later.

Potential Drawbacks of IRA Gold Accounts

While IRA gold accounts supply several benefits, there are additionally potential drawbacks to consider:

- Larger Fees: Investing in gold usually comes with greater charges compared to conventional IRAs. If you have any type of questions concerning where and how you can make use of best companies for investing in precious metals iras, you can call us at the web site. These fees can embrace account setup fees, storage fees for the bodily gold, and administration charges. It is important to know the price construction before committing to a gold IRA.

- Market Volatility: Though gold is often seen as a safe haven, its value will be volatile in the short time period. Traders should be prepared for value fluctuations and understand that gold might not all the time present immediate returns.

- Restricted Investment Options: Gold IRAs are restricted to particular varieties of valuable metals that meet IRS standards. This restriction can limit funding choices in comparison with a traditional IRA that allows a broader range of assets.

- Storage and Security Issues: Physical gold requires secure storage, which could be a priority for some investors. Whereas many custodians supply secure gold-backed ira accounts storage choices, the accountability for the safety of the asset ultimately lies with the investor.

Easy methods to Get Began with an IRA Gold Account

Getting started with an IRA gold account entails a number of steps:

- Choose a Custodian: The first step is to pick out a good custodian that makes a speciality of self-directed IRAs and has experience handling valuable metals. The custodian will manage the account, facilitate transactions, and ensure compliance with IRS regulations.

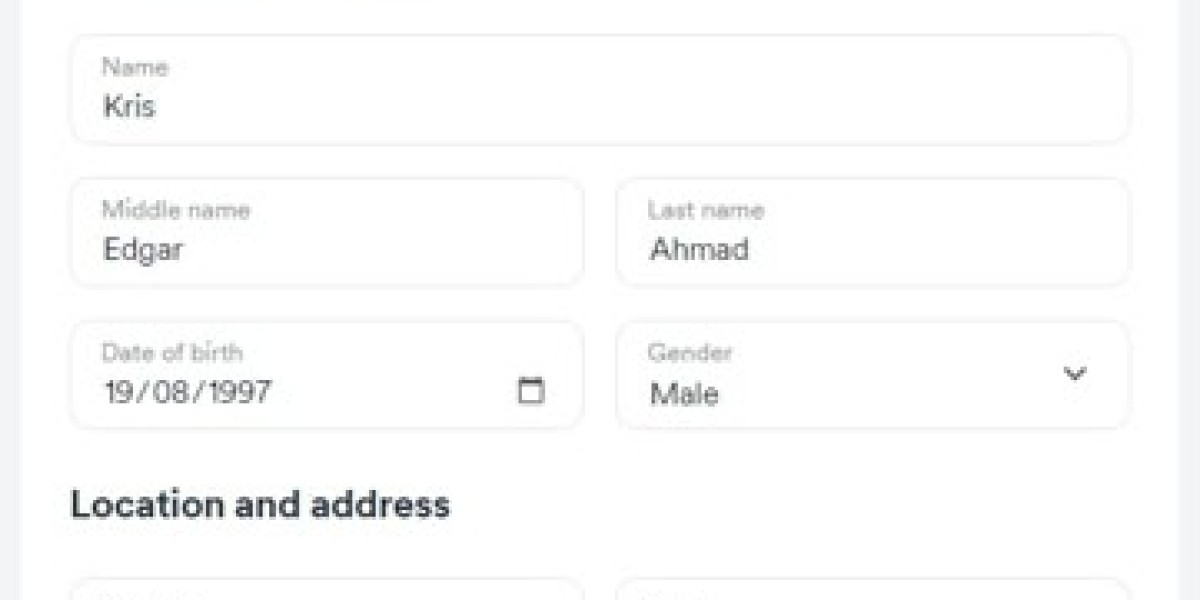

- Open a Self-Directed IRA: As soon as a custodian is chosen, the investor must open a self-directed affordable gold-backed ira investment accounts account. This process sometimes includes filling out an application and offering vital documentation.

- Fund the Account: Investors can fund their gold IRA by various methods, such as rolling over funds from an current retirement account, making direct contributions, or transferring property. It's crucial to adhere to IRS guidelines regarding contributions and rollovers to keep away from penalties.

- Select Treasured Metals: After funding the account, traders can choose which treasured metals to purchase. It is crucial to pick metals that meet IRS purity requirements and are authorised for IRA investments.

- Purchase and Retailer the Metals: The custodian will facilitate the acquisition of the selected metals and guarantee they are saved in an authorised depository. Buyers should affirm that the storage facility adheres to excessive-safety standards.

- Monitor the Funding: Like all investment, it is important to observe the efficiency of the gold IRA frequently. Buyers should keep informed about market traits, economic situations, and modifications in IRS laws that will have an effect on their investment.

Conclusion

best ira companies for gold 2024 gold accounts present a compelling choice for individuals trying to safe their retirement savings in an increasingly unsure financial panorama. With the potential for inflation safety, diversification, and tax advantages, gold IRAs can play a worthwhile function in a effectively-rounded retirement strategy. Nonetheless, potential investors ought to fastidiously consider the related costs, market volatility, and storage necessities before making a call. By understanding the basics of IRA gold accounts and following the necessary steps to ascertain one, traders can take proactive measures to safeguard their financial future and enjoy the peace of mind that comes with holding tangible property in their retirement portfolio.