In recent years, many buyers have turned to gold as a way to diversify their retirement portfolios and protect their assets in opposition to market volatility and inflation. One fashionable methodology of investing in gold is through a self-directed Individual Retirement Account (IRA) that allows for the transfer of funds to purchase physical gold. This article will explore the technique of transferring an IRA to gold, the benefits and risks concerned, and the key considerations to bear in mind.

What's a Gold IRA?

A Gold IRA is a type of self-directed IRA that permits buyers to hold bodily gold and other precious metals as part of their retirement financial savings. Unlike conventional IRAs, which typically spend money on stocks, bonds, and mutual funds, a Gold IRA offers traders the chance to diversify their portfolios with tangible property. The interior Income Service (IRS) permits sure varieties of precious metals, together with gold, silver, platinum, and palladium, to be held in these accounts.

Why Transfer an IRA to Gold?

- Inflation Hedge: Gold has historically been seen as a hedge in opposition to inflation. During durations of financial uncertainty, gold typically retains its value or even appreciates, making it a beautiful possibility for investors trying to guard their buying power.

- Diversification: By including top rated gold Ira companies to their portfolios, investors can reduce their general risk. Gold often moves independently of stocks and bonds, which means it may possibly provide stability throughout market downturns.

- Lengthy-Time period Value: Gold has been a store of value for 1000's of years. Many traders consider that it will continue to hold its worth over time, making it a reliable asset for retirement savings.

- Potential for Progress: Whereas gold is usually viewed as a secure haven, it also can admire in worth. Financial elements, geopolitical tensions, and adjustments in demand can all influence the value of gold, providing potential for capital positive aspects.

Tips on how to Transfer an IRA to Gold

Transferring an IRA to gold includes a number of steps. Here’s a breakdown of the method:

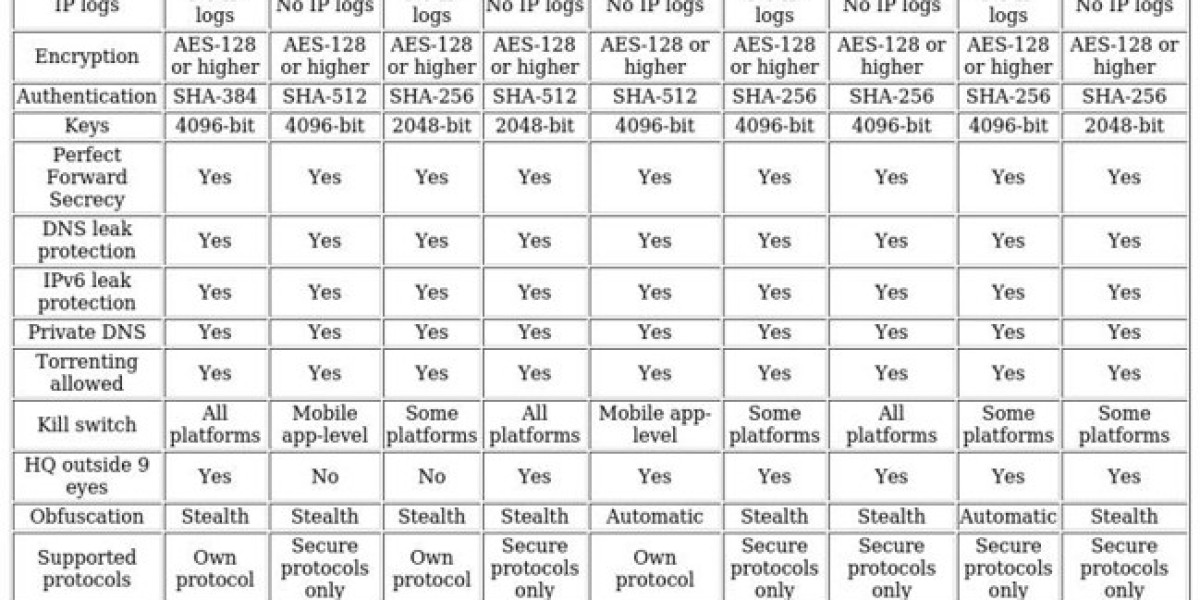

- Select a Self-Directed IRA Custodian: The first step is to select a custodian that makes a speciality of self-directed IRAs and has experience with treasured metals. The custodian will manage your account and guarantee compliance with IRS rules.

- Open a Gold IRA Account: After getting selected a custodian, you might want to open a new Gold IRA account. This account will probably be separate out of your present IRA.

- Initiate the Switch: Contact your present IRA provider and request a transfer of funds to your new Gold IRA. This could typically be done by way of a direct transfer or a rollover. A direct switch is often the simplest possibility, because it allows the funds to maneuver directly from one account to a different without the investor taking possession of the money.

- Select Your Treasured Metals: After the funds have been transferred, you'll be able to begin buying gold and different permitted treasured metals. Work together with your custodian to make sure that the metals meet IRS standards for purity and authenticity.

- Retailer Your Gold: The IRS requires that physical gold held in a Gold IRA be saved in an authorized depository. Your custodian can help you choose a safe storage facility that meets IRS regulations.

Benefits of Gold IRAs

- Tax Advantages: Gold IRAs supply the same tax advantages as conventional IRAs. Contributions could also be tax-deductible, and the investment grows tax-deferred until retirement.

- Safety from Market Fluctuations: Gold typically performs well throughout economic downturns, providing a buffer towards inventory market volatility.

- Tangible Asset: Unlike stocks and bonds, gold is a bodily asset that you may hold in your hand. This tangibility can present peace of mind to buyers.

Risks of Gold IRAs

- Market Risk: While gold can be a secure haven, its worth can still fluctuate based mostly on market situations, provide and demand, and geopolitical events.

- Storage Prices: Storing bodily gold in a secure facility incurs costs, which may eat into your general returns.

- Restricted Progress Potential: Unlike stocks, gold does not produce income or dividends. Investors could miss out on potential beneficial properties from other asset courses.

Key Issues Earlier than Transferring to Gold

- Perceive the Charges: Remember of the charges related to opening and maintaining a Gold IRA, together with custodian fees, storage charges, and transaction fees for purchasing gold.

- Analysis Your Custodian: Select a good custodian with a stable monitor report in managing Gold IRAs. Examine for reviews, rankings, and any complaints filed with regulatory companies.

- Know the IRS Rules: Familiarize your self with IRS guidelines relating to Gold IRAs, including which varieties of gold are eligible and the required purity ranges. Non-compliance may end up in penalties and taxes.

- Consider Your Funding Targets: Assess how gold suits into your total retirement strategy. It’s necessary to have a clear understanding of your threat tolerance and funding targets before making a major shift in your portfolio.

- Consult a Monetary Advisor: If you what are gold ira companies uncertain about transferring your IRA to gold, consider consulting a monetary advisor. They can provide personalised recommendation primarily based on your monetary situation and retirement objectives.

Conclusion

Transferring an IRA to gold is usually a strategic move for buyers seeking to diversify their retirement portfolios and protect their property against inflation and market volatility. Nevertheless, it’s essential to know the method, benefits, and risks involved. By conducting thorough research and working with respected custodians, investors can make informed choices that align with their long-time period monetary goals. As with all investment, careful consideration and planning are key to making certain a successful transition to a Gold IRA.