In immediately's quick-paced world, unexpected expenses can arise at any second. Whether it is a medical emergency, automotive restore, or an urgent invoice that needs to be paid, having immediate entry to money might be crucial. However, for individuals with dangerous credit, securing a loan generally is a daunting process. Quick cash loans for bad credit supply a possible answer, allowing these in have to access funds quickly. This text will explore what fast money loans are, how they work, their advantages and drawbacks, and tips for finding the right lender.

What are Fast Money Loans?

Fast money loans, also known as payday loans or money advance loans, are brief-time period loans designed to provide borrowers with instant cash. These loans are sometimes unsecured, which means they don't require collateral. Borrowers can apply for these loans online or in-person, and the approval course of is normally fast, usually completed inside a number of hours. The loan quantity can range, but it is generally small, ranging from just a few hundred to a couple thousand dollars.

How Do Fast Cash Loans Work?

The appliance course of for quick money loans is comparatively straightforward. Borrowers typically need to provide primary personal loans for bad credit wv info, proof of income, and a legitimate checking account. As soon as the applying is submitted, lenders assess the information provided and determine whether to approve the loan. If authorised, the funds are often deposited immediately into the borrower's bank account within a short interval, sometimes as quickly as the identical day.

Repayment phrases for quick cash loans range by lender but are generally short, usually requiring repayment within a few weeks to a month. Borrowers could also be required to pay curiosity and charges, which might be considerably greater than traditional loans, reflecting the higher risk related to lending to individuals with bad credit score.

Benefits of Quick Cash Loans for Bad Credit

- Accessibility: One among the primary advantages of fast money loans is their accessibility. Individuals with dangerous credit score usually discover it difficult to secure traditional loans from banks or credit unions. Quick money loans provide an alternate for individuals who may not qualify for other financing options.

- Velocity: Because the title suggests, fast money loans are designed to supply funds rapidly. This is usually a lifesaver for people facing pressing monetary wants.

- Minimal Requirements: Fast cash loans sometimes have fewer necessities in comparison with traditional loans. Borrowers may not have to bear extensive credit score checks, making it easier for those with poor credit score histories to qualify.

- Versatile Use: Borrowers can use quick money loans for various functions, including medical bills, car repairs, or unexpected bills. This flexibility makes them an appealing choice for many people.

Drawbacks of Fast Cash Loans

Regardless of their advantages, quick cash loans additionally come with important drawbacks that borrowers should consider:

- High Interest Charges: Fast cash loans typically carry excessive-interest charges and charges, which can result in a cycle of debt if borrowers are unable to repay the loan on time. The cost of borrowing can quickly escalate, making it essential for borrowers to understand the full repayment quantity earlier than agreeing to the loan.

- Short Repayment Terms: The quick repayment intervals associated with fast money loans can create monetary strain for borrowers. If they're unable to repay the loan by the due date, they could also be pressured to take out another loan to cover the previous one, leading to a cycle of debt.

- Potential for Predatory Lending: Some lenders could interact in predatory lending practices, concentrating on susceptible people with misleading phrases or excessive charges. It's essential for borrowers to analysis lenders thoroughly and browse the positive print earlier than agreeing to any loan.

- Impression on Credit Rating: Whereas fast cash loans may be accessible to those with dangerous credit, failing to repay the loan on time can further damage a borrower's credit score. This can create additional challenges in securing financing sooner or later.

Suggestions for locating the fitting Lender

If you are considering a fast money loan for unhealthy credit score, it is essential to approach the method with warning. Here are some tips to help you find the suitable lender:

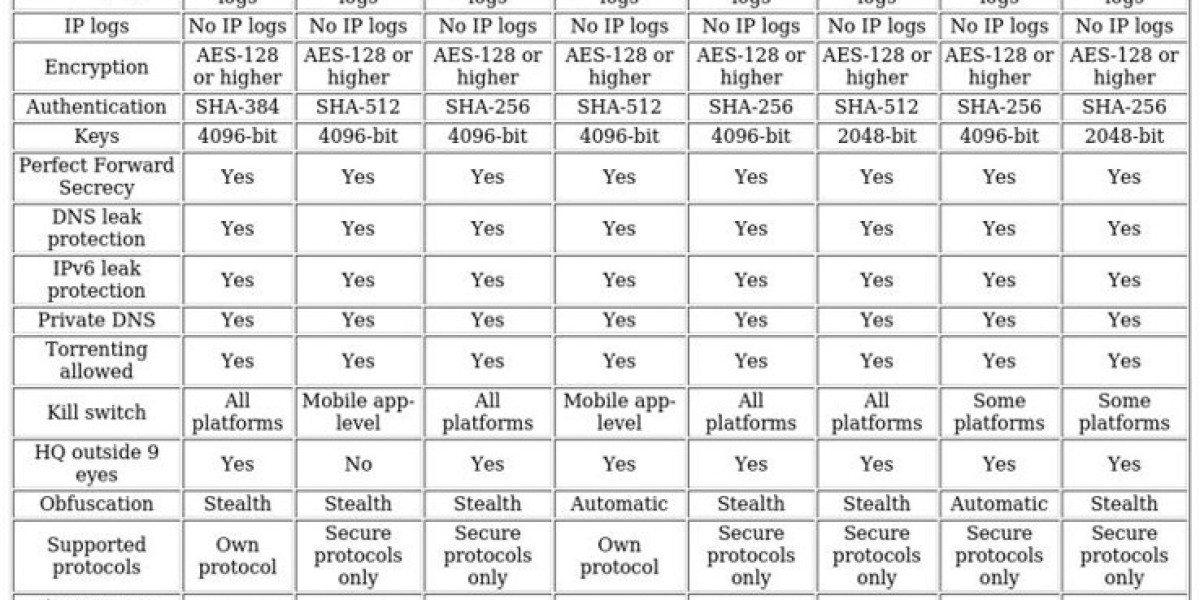

- Analysis Lenders: Take the time to research numerous lenders and examine their phrases, interest charges, and fees. Look for reputable lenders with optimistic evaluations and clear practices.

- Learn the Nice Print: Earlier than agreeing to any loan, rigorously read the terms and conditions. Listen to the interest rates, repayment terms, and any extra charges that may apply.

- Test for Licensing: Make sure that the lender is licensed to operate in your state. This may help protect you from predatory lending practices.

- Consider Alternate options: If possible, explore different financing options, similar to credit score unions or community assistance programs. These might offer extra favorable phrases and decrease curiosity charges.

- Plan for Repayment: Earlier than taking out a loan, create a repayment plan to ensure you may meet the terms. Consider your price range and any upcoming expenses to keep away from falling into a cycle of debt.

Conclusion

Quick cash loans for bad credit can present a much-wanted financial lifeline for individuals going through unexpected bills. However, they come with significant dangers, including high-curiosity rates and the potential for debt cycles. It is important for borrowers to strategy these loans with warning, totally research lenders, and understand the phrases earlier than committing. By being knowledgeable and prepared, borrowers could make higher financial selections and discover the right resolution for their wants. Always remember to explore all accessible options and seek help if wanted, ensuring that you make the best place to get a personal loan with bad credit choice for your monetary future.