In recent times, the financial landscape has seen a significant shift in direction of alternative investment strategies, with gold and different valuable metals gaining traction among buyers. Some of the notable traits on this domain is the increasing curiosity in Gold Individual Retirement Accounts (IRAs). Gold IRA kits have emerged as a preferred means for people to diversify their retirement portfolios and hedge towards economic uncertainties. This observational analysis article delves into the elements, advantages, and concerns surrounding Gold IRA kits, primarily based on latest market trends and shopper behaviors.

Gold IRAs enable individuals to hold physical gold, silver, platinum, and palladium of their retirement accounts, offering a tangible asset possibility that is commonly seen as a safe haven throughout unstable market conditions. The attraction of gold as a protracted-time period funding is rooted in its historic worth and intrinsic value, which tends to stay stable or respect over time, especially throughout periods of inflation or financial downturns.

The process of establishing a Gold IRA usually begins with the acquisition of a Gold IRA kit. These kits are supplied by various financial institutions and firms specializing in valuable steel investments. A typical Gold IRA kit consists of essential information and sources reminiscent of a guide to establishing the account, a list of IRS-accepted gold ira investment analysis products, and instructions on how to purchase and retailer the metals securely. Observationally, many of those kits are marketed with an emphasis on simplicity and accessibility, interesting to a broad audience, including first-time buyers and people seeking to diversify their present retirement financial savings.

One notable observation is the demographic shift amongst Gold IRA buyers. Traditionally, gold investment has been favored by older generations searching for to preserve wealth. Nevertheless, latest traits indicate that youthful investors, significantly Millennials and Gen Z, are more and more all in favour of gold as a viable investment choice. This shift will be attributed to several factors, including a rising distrust in conventional monetary methods, the impact of economic events such as the COVID-19 pandemic, and a heightened consciousness of inflation dangers. As these youthful traders search stability, Gold IRA kits provide a simple means to have interaction with treasured metals, typically accompanied by academic resources that demystify the funding course of.

The benefits of Gold trusted gold-backed ira firms kits lengthen beyond mere asset diversification. One significant benefit is the potential for tax benefits. Contributions to a Gold IRA are typically tax-deductible, and the growth throughout the account is tax-deferred until withdrawal. This characteristic is especially interesting to traders trying to maximize their retirement savings whereas minimizing tax liabilities. Furthermore, gold investments are not topic to the same market fluctuations as stocks and bonds, offering a degree of safety that can be significantly engaging throughout economic instability.

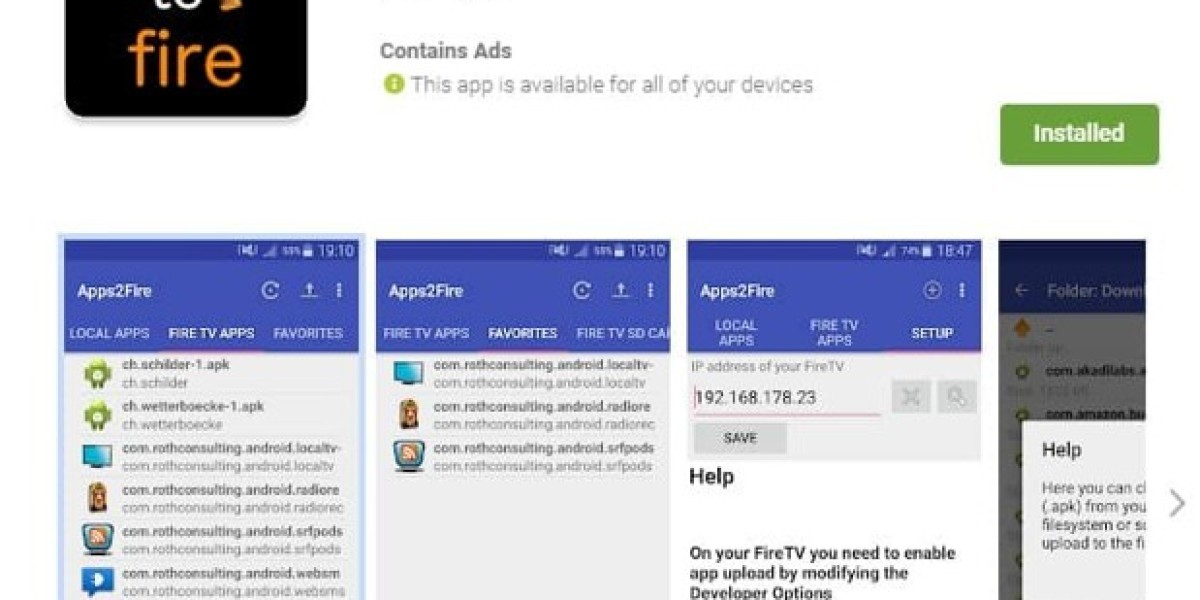

One other vital statement is the position of expertise in the Gold IRA investment course of. Many best-rated companies for retirement gold-backed iras now offer online platforms the place traders can simply manage their Gold IRAs, track the performance of their investments, and entry educational sources. This technological integration has made it easier for traders to engage with their portfolios, rising the general accessibility of gold investments. Moreover, the rise of social media and on-line forums has facilitated discussions about gold investing, permitting individuals to share experiences, tips, and techniques. This group-driven strategy has fostered a supportive atmosphere for each novice and seasoned buyers.

However, potential traders must also bear in mind of the dangers and challenges associated with Gold IRAs. Considered one of the first concerns is the price of purchasing and storing bodily gold. Gold IRA kits often come with associated fees, together with setup fees, storage fees, and management charges, which may eat into general returns. Furthermore, while gold is considered a comparatively stable funding, it isn't entirely immune to market fluctuations. Investors have to be prepared for the likelihood that the value of their gold holdings might fluctuate primarily based on market demand, geopolitical events, and adjustments in the global financial system.

Another consideration is the significance of due diligence when selecting a Gold IRA supplier. If you cherished this short article and you would like to obtain far more details about https://ereproperty.ru kindly stop by our web-site. With the rising popularity of gold investments, the market has seen an inflow of companies providing Gold IRA kits. Nevertheless, not all suppliers are created equal. Investors should thoroughly research potential best-rated firms for precious metals ira, in search of evaluations, ratings, and any potential pink flags such as hidden fees or poor customer support. Ensuring that the chosen supplier is reputable and compliant with IRS regulations is essential for a successful Gold IRA investment.

In conclusion, the rising popularity of Gold IRA kits displays a broader pattern toward various investments as individuals search to safeguard their retirement savings. The mixture of tax advantages, the allure of tangible assets, and the rising accessibility of gold investment by means of expertise has contributed to the rising curiosity in Gold IRAs. Nonetheless, potential traders must remain vigilant, conducting thorough research and considering the associated costs and dangers. Because the financial panorama continues to evolve, Gold IRA kits could play an more and more outstanding function in retirement planning for both seasoned buyers and newcomers alike. The ongoing observations and developments in this house indicate that gold, as an funding car, will remain relevant within the years to return, offering people with a sense of security and stability in an ever-altering financial setting.