Lately, the allure of gold as a hedge in opposition to financial uncertainty has led many investors to contemplate a Gold Individual Retirement Account (IRA). This financial instrument allows individuals to put money into gold and other treasured metals as a part of their retirement financial savings strategy. This article explores the benefits, dangers, and important considerations for investing in a Gold IRA, providing a comprehensive guide for prospective investors.

Understanding Gold IRAs

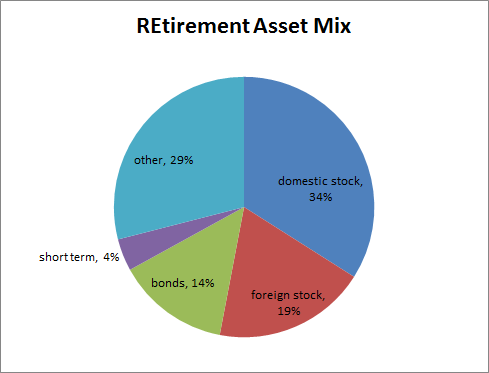

A Gold IRA is a type of self-directed particular person retirement account that allows investors to carry physical gold and different precious metals, comparable to silver, platinum, and palladium, as part of their retirement portfolio. In contrast to traditional IRAs that usually hold stocks, bonds, and mutual funds, a Gold IRA offers a chance to diversify one's funding by incorporating tangible belongings.

The advantages of Investing in a Gold IRA

- Hedge Towards Inflation: Considered one of the first causes traders turn to best gold ira investment accounts is its historic position as a hedge in opposition to inflation. As the price of living rises, the value of gold tends to extend, preserving purchasing energy over time.

- Diversification: A Gold IRA allows investors to diversify their retirement portfolios. By including physical gold, traders can cut back their exposure to market volatility and the dangers related to traditional investments.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that may be held and stored. This tangibility can provide a way of security for buyers who are involved about financial instability or foreign money devaluation.

- Tax Advantages: Gold IRAs provide related tax benefits to conventional IRAs. Contributions may be tax-deductible, and investments develop tax-deferred until withdrawals are made during retirement.

- Lengthy-Time period Progress Potential: Historically, gold has proven a tendency to appreciate over the long run. While quick-term fluctuations can occur, many traders view gold as a dependable retailer of worth.

Risks and Considerations

Whereas there are significant benefits to investing in a Gold IRA, potential buyers must also remember of the associated risks and considerations:

- Market Volatility: Although gold is commonly thought of a safe haven, its worth may be unstable in the brief term. Investors should be prepared for fluctuations in worth and have a long-time period perspective.

- Storage and Insurance Prices: Bodily top gold ira investment companies should be stored securely, typically in a chosen depository. This incurs storage charges and should require extra insurance coverage prices to protect towards loss or theft.

- Restricted Investment Options: Gold IRAs are limited to particular varieties of gold and valuable metals that meet IRS standards. This restriction can restrict investment choices compared to conventional IRAs.

- Potential Fees: Establishing a Gold IRA could contain increased charges than traditional IRAs. Investors should fastidiously evaluation all related costs, together with setup fees, storage charges, and management charges.

- Regulatory Adjustments: The regulatory environment surrounding retirement accounts can change. Buyers must keep informed about any changes that may impression their Gold IRA.

Organising a Gold IRA

Establishing a Gold IRA involves several steps:

- Select a Custodian: Step one is to select a custodian who makes a speciality of self-directed IRAs and has expertise with treasured metals. If you have any concerns pertaining to where and how you can make use of affordable gold ira investments usa, you can call us at our own web site. The custodian will handle the administrative duties and ensure compliance with IRS rules.

- Open an Account: As soon as a custodian is chosen, buyers can open a Gold IRA account. This process typically includes filling out an utility and offering needed documentation.

- Fund the Account: Traders can fund their Gold IRA through various strategies, including rollovers from existing retirement accounts, direct contributions, or transfers from different IRAs.

- Choose Treasured Metals: After funding the account, investors can choose which kinds of valuable metals to purchase. The IRS has particular necessities for the kinds of gold that may be held in a Gold IRA, together with bullion coins and bars that meet certain purity standards.

- Buy and Store the Metals: Once the choice is made, the custodian will facilitate the acquisition of the metals. The bodily gold must be stored in an permitted depository, which ensures compliance with IRS laws regarding the safekeeping of valuable metals.

Conclusion

Investing in a Gold IRA could be a strategic transfer for those trying to diversify their retirement portfolios and protect their savings in opposition to economic uncertainty. Whereas there are important benefits, together with inflation hedging and long-time period progress potential, buyers should additionally consider the related risks and prices. By rigorously evaluating their options and dealing with skilled custodians, investors can make knowledgeable decisions that align with their financial objectives.

As with all investment, it's crucial to conduct thorough research and seek the advice of with financial advisors to make sure that a Gold IRA aligns with particular person retirement strategies. With the precise approach, a Gold IRA can function a precious part of a well-rounded retirement plan, offering each safety and progress potential in an ever-altering financial panorama.